- Home

- Sustainability

- Corporate Governance

- Officer Remuneration System

Officer Remuneration System

Policy on Determining Remuneration for Directors and Executive Officers

The company formulated and announced its “Officer Remuneration Policy” in April 2017, and further changed the officer remuneration system in accordance with the Medium-term Business Plan from May 27,2021. Moreover we revised the officer remuneration system and the officer remuneration policy in accordance with the medium-term management plan starting from FY 2024.

In the revision, a new calculation method for officer remuneration has been being introduced in order to further enhance the objectivity and transparency of the overall remuneration level and system, utilizing research conducted by a third-party organization.

From the perspective of further increasing the desire to contribute to improving corporate value over the medium to long term and sharing profits with shareholders, we have reviewed the evaluation indicators and evaluation weights for stock compensation linked to the performance-linked ratio and stock based remuneration ratio, and bonuses that reflect the performance of individual officers and stock compensation linked to company-wide consolidated performance.

Our officer remuneration system is based on the following basic policies, aiming to achieve the objectives of realizing and promoting sustainability management (pay for purpose). The same basic policies shall apply to the Directors and Executive Officers of Daimaru Matsuzakaya Department Stores and Parco, both of which are major subsidiaries in the Group, and the Representative Directors ofJ. Front City Development, J. Front Card and J. Front Design & Construction.

● Contributing to the sustainable growth of the Group and increasing corporate value over the medium to long term;

● Establishing a remuneration system that facilitates the achievement of duties (mission) based on the management strategies of professional corporate managers;

● Remuneration levels that can secure and retain personnel who have the “desirable managerial talent qualities” required by the Company;

● Increasing shared awareness of profits with shareholders and awareness of shareholder-focused management;

and

● Enhanced transparency and objectivity in the remuneration determining process.

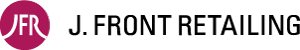

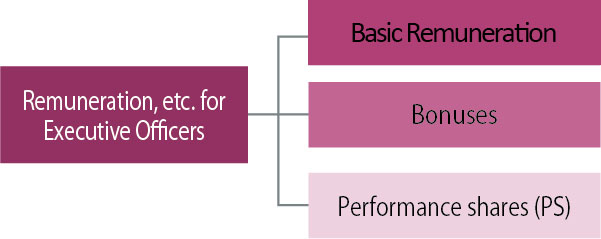

Remuneration Composition for Executive Officers and Non-executive Directors

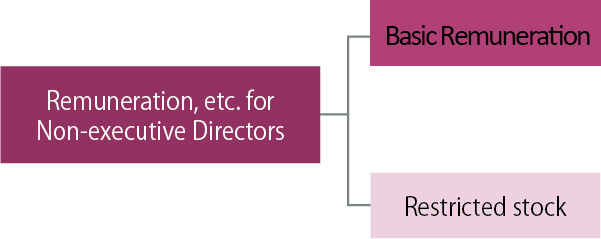

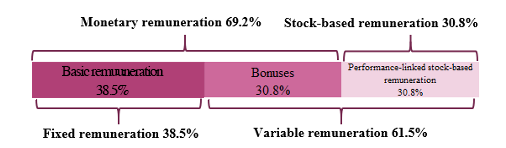

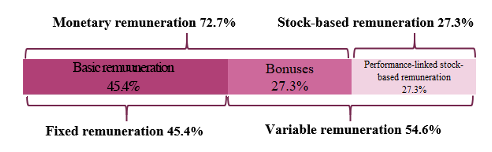

Proportion of remuneration by type for Executive Officers

※One of the following applies in accordance with responsibilities

Note:The same remuneration composition as above is also to apply in accordance with job size with regard to eligible officers of major subsidiaries of the Group.

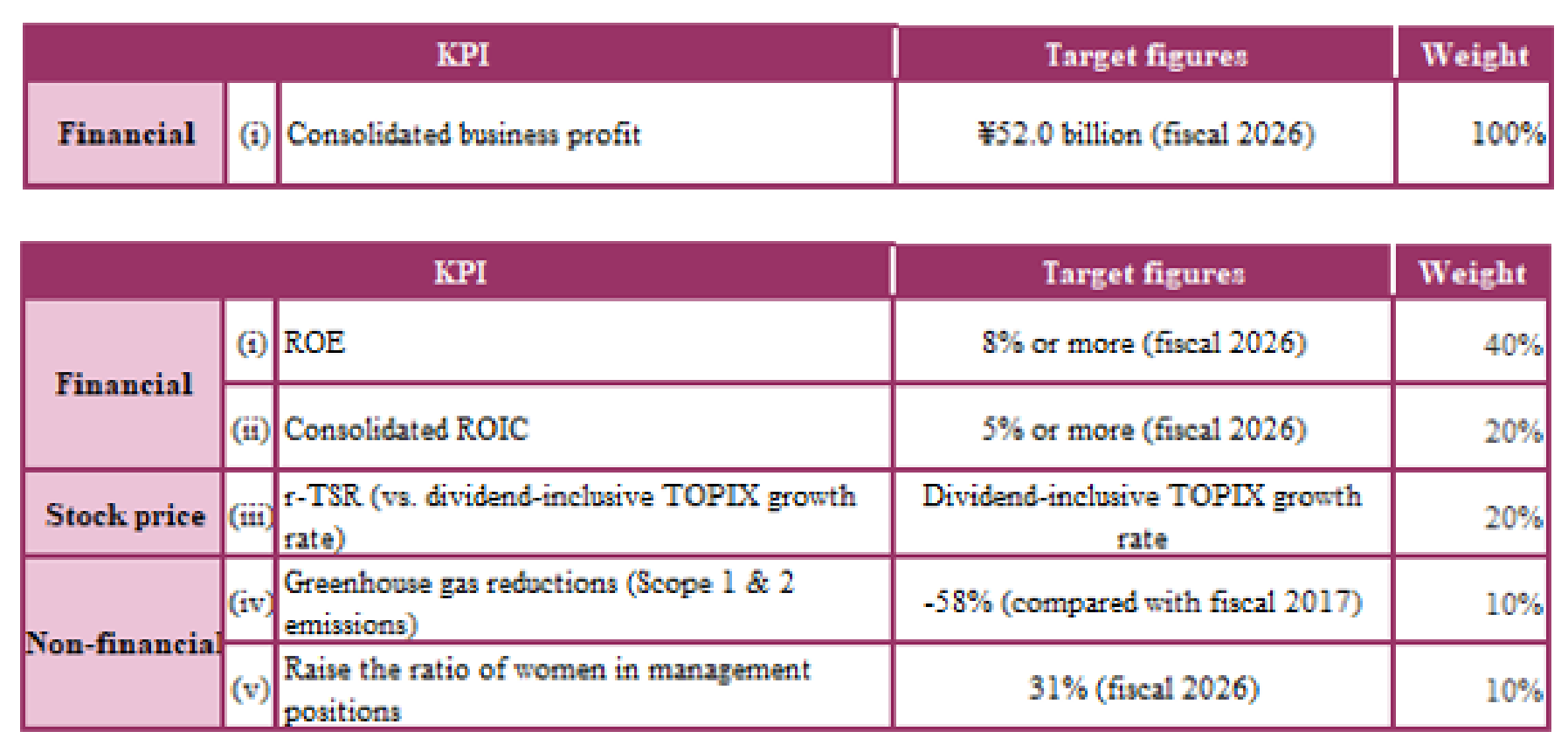

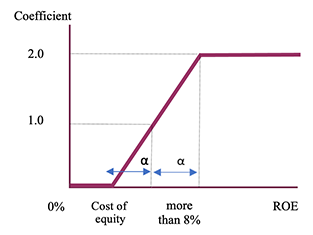

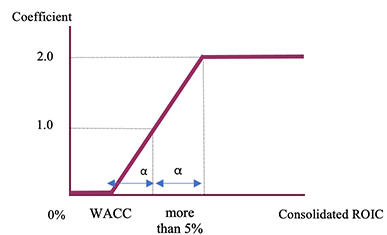

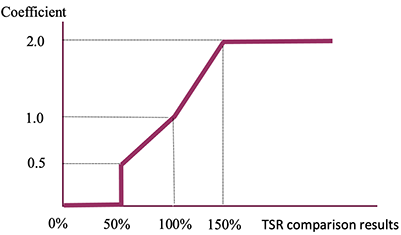

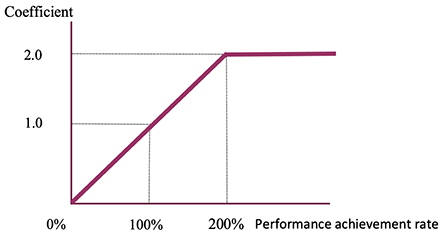

Target figures and evaluation weights for performance-linked stock-based remuneration

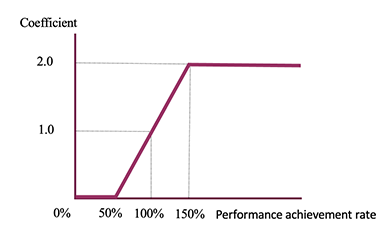

Conceptual drawing of performance-linked coefficient fluctuation

Procedures for Determining Remuneration for Directors and Executive Officers

To ensure that remuneration levels and remuneration amounts are appropriate and that their determination process is transparent, the determination of the specific remuneration amounts to be paid is made by the deliberation and resolution of the Remuneration Committee, which is comprised of three independent Outside Directors and a non-executive Director from inside the Company and is chaired by an independent Outside Director.

The Remuneration Committee meetings are to be held at least four times per year and the Company plans to conduct a review of the officer remuneration system upon the completion of the period of each Medium-term Business Plan.

The levels of basic remuneration, will be revised in case a significant revision is required due to dramatic changes, etc. in the external environment and other reasons during the Medium-term Business Plan period.

Forfeiture of Remuneration (Clawback and Malus)

Regarding Executive Officers’ bonuses and stock-based remuneration, in the event that a resolution is passed by the Board of Directors regarding the post-revision of financial results due to serious accounting errors or improprieties, in the event that there has been a serious breach of the appointment contract, etc. between the Company and an officer, or in the event that an officer has voluntarily retired for his/her own reasons during his/her term of office against the will of the Company, the Company may request the forfeiture of the right to pay or grant remuneration or the refund of remuneration that has already been paid or granted to the officer.

Corporate Governance

-

Corporate Governance System

-

Board of Directors

-

Nomination Committee, Audit Committee, and Remuneration Committee

-

Nomination/Appointment/Succession Planning

-

Officer Remuneration System

-

Evaluation of the Effectiveness of the Board of Directors

-

Basic Capital Policy/Shareholder Return Policy/Cross-Shareholdings

-

JFR Tax Policy