- Home

- IR Information

- Management Policy

- Medium-term Business Plan

Medium-term Business Plan

Review of Previous Medium-term Business Plan

• Although the impact of COVID-19 persisted longer than initially envisioned, working to steadily capture the recovery in demand in the latter half of the previous medium-term business plan, the Company was able to recover our consolidated operating profit to pre-COVID-19 levels as a result of the strategies at flagship department stores and the shopping center business (the “SC business”) and management structural reforms such as reducing fixed expenses, and also broadly improve our financial position through reducing interest-bearing liabilities.

• With 2030 as our regrowth milestone, the Company promoted both our primary business and our Developer Strategy, first by formulating the medium- to long-term plan and promoting business restructuring and then, from the perspective of business portfolio reform, undertaking of measures to improve business efficiency through such efforts as establishing investment and funds for the creation of new business and assessing business opportunities.

| Efforts aimed a “full recovery” | Efforts aimed at “regrowth” |

|---|---|

|

• Large-scale refurbishments of department stores and SC aimed at improving store charm and enhancement of major categories. • Promotion of shift to digital methods for interaction with customers, including apps. • Reduction in fixed expenses beyond what was originally planned. |

• Restructuring of the business promotion system for the Developer Strategy from the perspective of overall Group optimization. Formulation of the development plans for the medium to long term. • Strengthening of the creation and discovery of appealing content through the establishment of the “JFR MIRAI CREATORS Fund,” the business succession fund, among others. |

The management approach in heading toward 2030

The Company is promoting corporate activities that are aligned with “sustainability management” aimed at tackling environmental and social issues and finding solutions for them through business in order to realize the Group Vision of “Create and Bring to Life ‘New Happiness.’” Moreover, the Company recognizes our strengths as being our excellent customer base and store real estate primarily in major cities across Japan, the connections and trust it has with our stakeholders, and the capabilities of creation and management of commercial spaces/experiences and overall discernment it has cultivated through the department stores, PARCO, and others.

In defining our management approach for the coming years, the Company, after considering the aforementioned strengths that the Company possesses, along with important changes in the business environment, has drawn up a “Vision for 2030.” The Company intends to evolve into a “Value Co-creation Retailer Group” that constantly provides “Three Values of Co-creation” centered on the retail businesses.

(1) Changes in the business environment affecting the Company

| Consumption |

・Generational change in key purchasers, progress in globalization (inbound tourist demand, etc.) ・Growing desire for “connections of empathy, support, and trust” that satisfy the heart ・A further increase in awareness of “circularity” from the cycle of production and consumption |

|---|---|

| Market |

・Domestic population decline, growing income disparity ・Progress in the renewal and consolidation of urban functions and urban development ・Decrease in the number of players in local economies and increasing interest in local traditions and culture |

| Society |

・Increasing severity of environmental problems, such as climate change, and the manifestation of geopolitical risks ・Less connected to people and communities and the rise of digital communities ・Increasing labor shortages; more emphasis on self-fulfillment, social contribution, etc. when choosing a job. |

(2) Vision for 2030

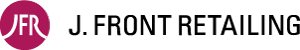

1) Three Values of Co-creation – Our Materiality

Leveraging the solid foundation provided by the Company’s inherent strengths without being constrained by traditional boundaries, the Company will cultivate a culture in which anyone can share in the creation of new values that offer heart-felt fulfillment for customers, thereby contributing to raising the charm and vitality of cities, while building a sustainable environment and society.

Concentrating on the retail businesses, the Company will broaden the wheel of “Co-creation” with our stakeholders, particularly our customers, continually providing the following three values of co-creation:

“Co-creation of Excitement”

Customers and employees working together to generate excitement.

“Co-prosperity with Communities”

Enhancing local community charm while giving it an important and essential presence.

“Co-existence with the Environment”

Cultivating a culture in which anyone can contribute to building a society that co-exists with the environment.

Based on the above three values of co-creation, the Company has reviewed our materiality to designate five themes of materiality. We are promoting the alignment of these initiatives for materiality with our business strategies and working to realize sustainable growth for the Company and a “Well-Being Life” for all our stakeholders.

2) Strategic Approach

Through overwhelming support from the domestic and overseas

premium and aspirational consumer group, we will evolve into a “Value Co-creation Retailer

Group” to always offer the three values of co-creation

• In today’s world, as consumption diversity advances, we are seeing a vanishing desire for uniformity in products and services. As such, the Company aims to evolve into a “Value Co-creation Retailer Group” that constantly provides the three values of co-creation to the premium and aspirational consumer group (all individuals who favor consuming high-quality goods and having heart-lifting experiences that fulfill their own preferences and values).

• To realize this goal, the Company believes it is now necessary to integrate the JFR Group’s efforts more than ever before and extend our strengths. For this purpose, along with deepening our retail business, we aim to grow exponentially by pursuing synergies that JFR Group offers in the three areas of “customer,” “area” and “content” outlined below.

“Customer” Synergy:

In addition to deepening our excellent customer base, the Company will strengthen connections with new customers, including overseas customers and generations Y (millennials) and Z (collectively hereinafter the “MZ generations”). We will connect with our customers across stores, business companies, and regions, and continue to be a partner chosen by our customers throughout their lives.

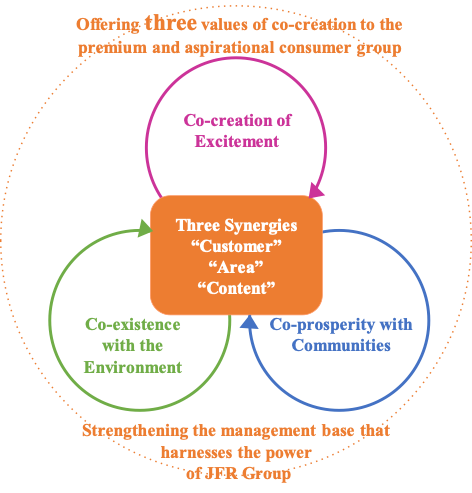

“Area” Synergy:

The Company will utilize store real estate and business foundations in major cities nationwide across the JFR Group to contribute to enhancing city charm. Especially in the seven priority areas*, the Company will hone the uniqueness of our department stores and PARCO stores, and work on creating vibrant cities and further enhancing their charm through medium- to long-term development plans, customer collaboration within the area and promotion of foot-traffic circulation.

* Priority areas: Sapporo, Tokyo, Nagoya, Kyoto, Osaka, Kobe, and Fukuoka

“Content” Synergy:

The Company will promote the development of our own content for new growth in the retail business, including business expansion in Japan as well as overseas and in the digital domain, by creating a synergistic fusion encompassing our cultivated discernment and purchasing power, along with JFR Group’s network of connections with regions, business partners and creators.

In order to realize these three areas of synergies, the Company is working to strengthen the management foundation into one that is capable of bringing together the capabilities of the JFR Group, such as the cross-pollination of talent and the integration of systems, that give rise to new value.

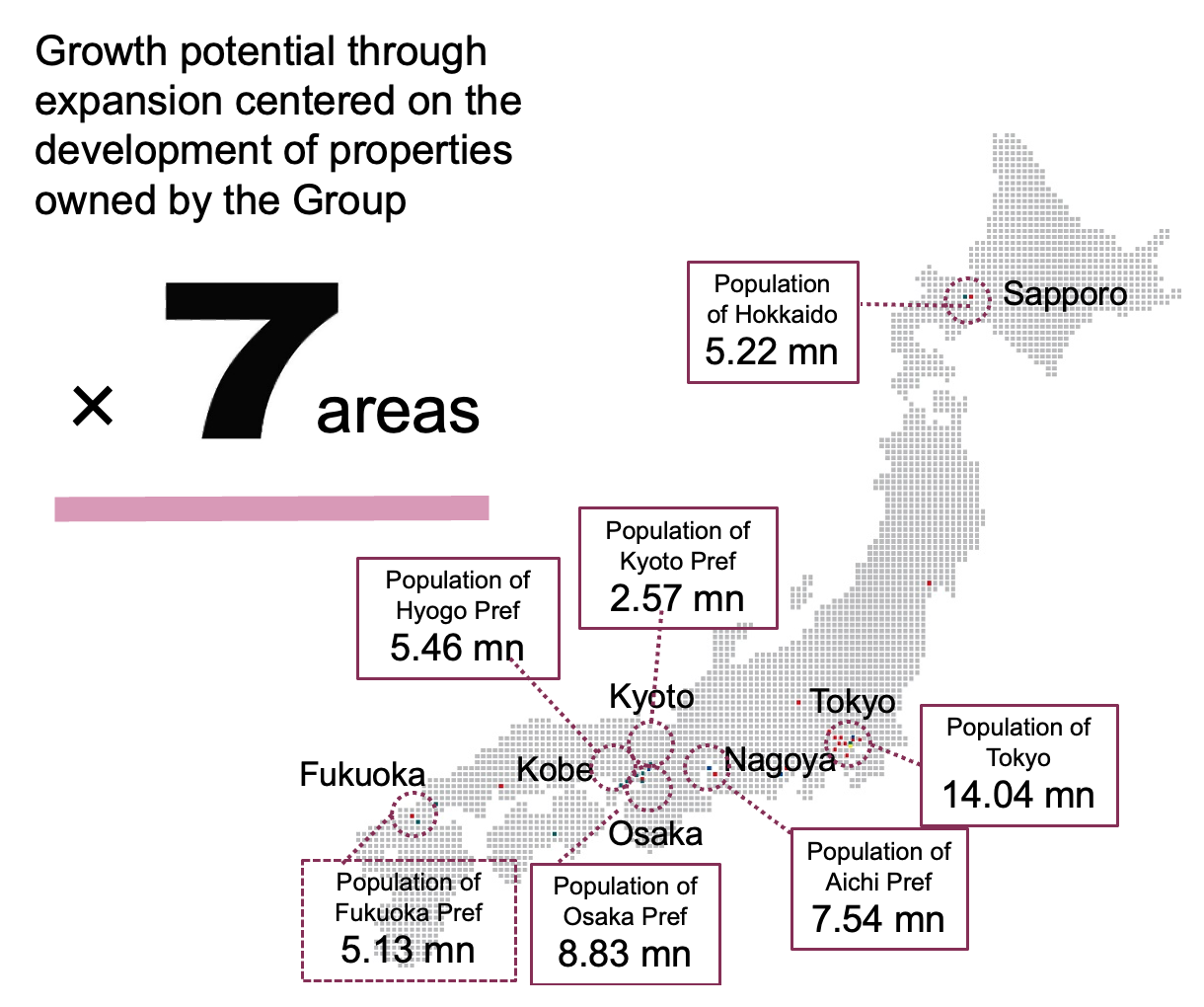

2024–2026 Medium-term Business Plan

(1) Positioning of the Medium-term Business Plan Within the Overall Long-term Strategy

• This medium-term business plan is positioned as a “period of reform” to ensure JFR Group’s realization of the Vision for 2030, and achievement of medium- to long-term growth.

• Specifically to achieve this, under this plan, the Company is targeting the creation of profits centered on the principle retail businesses (Department Store Business and SC Business), and in addition, planning to expand upfront investments and growth strategy investments aimed at bringing about the synergies of the JFR Group.

• Initiatives will be concentrated on the key strategies of this medium-term business plan: “Deepening the Retail Businesses,” “Evolving Group Synergies,” and “Strengthening the Group Management Foundation.”

(2) Key Performance Indicator Targets

The Company has set the following financial targets for the final year of this medium-term business plan (FY2026 ending February 28, 2027), which is positioned as the “period of reform.” the Company is targeting consolidated business profit (on an IFRS basis) of \56.0 billion, and a consolidated ROE of 8.0% or higher. We have also set the following non-financial targets. the Company aims to achieve 70% greenhouse gas emission reduction target*, and a 31% ratio of women in management positions.

[Primary Key Performance Indicator Targets]

(3) Financial and Capital Policy

Aiming to improve capital return over the medium to long term, the Company will take measures to “realize growth through profitability” and “optimize the level of shareholders’ equity and strengthen shareholder returns.”

(i) Realizing Growth Through Profitability

• To improve capital return, the Company will promote ROE management on a consolidated basis and ROIC management on an individual business segment basis. While we will expand growth investment that targets 2030, we will bring about growth through profitability by establishing strict management over investment based on growth and profit potential.

• In the investment plan for this medium-term business plan, investment priority will be allocated to the retail businesses, as well as to upfront investment or growth strategy investment for the Developer Business, which aims to bring about JFR Group synergies.

(ii) Optimizing the Level of Shareholders’ Equity and Strengthening Shareholder Returns

• The Company will build a financial foundation that is aimed both at profit creation through business growth and at continuous improvement of capital profitability.

• Under this medium-term business plan, the Company will work to optimize the level of shareholders’ equity and strengthen shareholder returns by targeting a consolidated dividend payout ratio of 40% or higher, while making purchases of our own shares (purchase of treasury shares).

(4) Overview of the Medium-term Business Plan

1) Deepening of the Retail Businesses

(i) Expansion of Domestic and Overseas Customer Groups

• In the Department Store Business, the Company will work to expand the customer base primarily through establishing a platform for department store gaisho, which includes such initiatives as expanding the scope of services targeting valued customers who use apps, and broadening gaisho activities. the Company will also promote gaisho collaboration with PARCO stores and other members of the JFR Group.

• In the SC Business, the Company will work with JFR Card Co., Ltd. to promote card membership, which will entail, alongside app members, membership acquisition triggered by the issuance of new cards.

• In both the Department Store Business and the SC Business, the Company will work to strengthen relations with overseas customers, including initiatives not only to assist inbound overseas tourists in visiting various stores of the JFR Group, and strengthen the dissemination of information, but also forming cooperative agreements with overseas companies mainly in Asia concerning customer collaboration and mutually beneficial use of store facilities.

(ii) Enhancing the Charm of Customer Touchpoint

• In the Department Store Business, the Company will enhance the charm of stores, which are the starting points of customer interaction, and establish competitive advantages in various regions. Focusing on flagship stores, including the Matsuzakaya Nagoya store, we will not only continue to strengthen our key categories but also work on creating sales areas that appeal to the next generation of customers, such as the MZ generations, and to market changes. In addition, we will strive to improve the spatial value, for example, by providing high-quality and comfortable store environments and environmentally friendly designs.

• To expand customer touchpoints using digital technology, we will work on enhancing customer communication through initiatives to renew both the department store app and the dedicated customer website.

• In the SC Business, in order to enhance PARCO’s unique brand value and the value of visiting our stores, we will carry out strategic renovations aimed at expanding support from the MZ generations and overseas customers, focusing on four key stores. This will include the first major renovations at Shibuya PARCO and Shinsaibashi PARCO, as well as efforts in Nagoya PARCO to introduce the largest entertainment and pop culture aggregation in the area and the introduction of next-generation fashion.

• We will enhance communication to customers by fully utilizing customer data for both PARCO store and online customers, and introduce services for members, aiming to enhance the charm of customer touchpoints.

(iii) Enhancing Content for Premium and Aspirational Consumer Group

• In the Department Store business, in addition to continuously strengthening luxury brands and watches, which enjoy a high level of support from both domestic and overseas customers, we will propose new lifestyles that respond to market changes, focusing on such areas as fashion, beauty and health.

• Furthermore, we will work on expanding new products and services through collaboration with external companies with the aim of strengthening our efforts to attract the affluent market.

• In the SC Business, through store renovations, we will develop Japan pop culture zones and introduce brands in collaboration with department stores. In addition, we will enhance entertainment including those aspects considered to be PARCO’s strengths, such as theater, music, movies, and digital events like eSports competitions.

2) Evolving Group Synergies

(i) Expand JFR Group’s Customer Base

• During the period of this medium-term business plan, along with expanding and integrating app membership, the Company will consolidate the issuance of proprietary cards by various companies, such as those issued by GINZA SIX and PARCO. Also, in order to leverage the establishment of a group-wide payment infrastructure as an opportunity, the Company will work on expanding the group customer base and enhance the lifetime value (LTV) of customers.

• The Company will advance customer collaboration beyond the boundaries of business and stores. Aside from that, we plan and promote a group customer strategy focused on the priority areas through analysis and utilization of customer databases, among other methods.

(ii) Maximize Value of Areas

• Among the seven priority areas, this medium-term business plan will focus intensively on creating synergy in the “Nagoya’s Sakae area.”

• Through significant renovations at the Matsuzakaya Nagoya store and Nagoya PARCO, in conjunction with the opening of a commercial complex by the Developer Business (scheduled for 2026), and the expansion of external affiliate stores accepting the JFR card, we will promote ways for JFR Group facilities to mutually encourage customers to visit other facilities in the group and also promote the circulation of customer foot traffic throughout the area. Through these efforts, we aim to contribute to the creation of a vibrant city and enhance its charm to maximize the value of the area.

• In addition to the opening of commercial complexes in “Nagoya’s Sakae area” and “Osaka’s Shinsaibashi area” (scheduled for 2026), the Company will strengthen investments in the Developer Business to promote development plans in the “Fukuoka’s Tenjin area”. Meanwhile, we will work on improving profitability through utilization underperforming assets, the selling or replacing of assets, and other such means.

• We plan to consolidate and reorganize the current construction and interior design business and building management business, to steer business expansion mainly toward the creation of high-quality spatial value, the improvement of service quality such as in maintenance and management of facilities, and the securing and training of specialized personnel, with the intention of providing such services, mostly in the priority areas, to facilities inside and outside the JFR Group.

(iii) Own and Develop Proprietary Content

To achieve new growth in the retail businesses, the Company will work to collectively harness the discernment, purchasing power, networks and other organizational competencies possessed by the department stores, PARCO and other shopping centers to further advance efforts to develop and own proprietary content and services, etc. and also develop new businesses through collaboration with other companies, targeting such business deployment not only for domestic operations but also for the overseas and digital realms.

• Leveraging the strength of having a business base in major cities nationwide, we will work on discovering and nurturing unique local products and services, including food culture, that are characteristic of each region.

• In addition to attracting new content and tenants that are ahead of the times, the Company will consider the development, ownership, etc. of content such as games centered around subcultures.

• Alongside efforts to strengthen the subscription business, the Company will promote the development of new businesses that encourage a circulatory model of consumption, among others, through entering into collaborations with other companies.

• To accelerate these initiatives, the Company will proceed more strongly with growth strategy investments including M&A, entering into alliances with other companies, the Company’s business succession and CVC funds.

Strengthening the Group Management Foundation

We will work together as the JFR Group to realize the “Vision for 2030” and strengthen the management foundation that enhances the effectiveness of our strategies. In particular, we will accelerate our efforts on focusing investment in our human resources, which are the source of value creation, and on promoting a human resource strategy.

(i ) Human Resource Strategy

• We will promote a human resource strategy integrated with the management strategy. Such a strategy will include strengthening the recruitment and development of highly specialized personnel, planned nurturing of next generation talents, and promoting women’s active participation.

• We will invigorate the internal exchange of personnel within the group, with the aim of achieving a fusion of “knowledge” possessed by employees and expand opportunities for active participation, thereby fostering a culture of challenge.

• We will create an environment and establish systems where every employee can take on challenges, drawing out employee’s ideas, motivations and abilities, and work towards realizing a human resource development company that aims for the sustainable growth of people and organizations.

(ii ) Financial Strategy

• To improve medium- to long-term capital profitability, we will thoroughly manage investments based on growth and profitability, and enhance ROIC management, mainly by entrenching its practice throughout the JFR Group with the cooperation of the business companies.

• Taking into account trends in capital markets, we will strengthen our financial position by generating free cash flow, securing long-term stable funds and controlling interest-bearing liabilities.

(iii) System Strategy

• We will build a common system for the entire JFR Group together with groupware to encourage collaboration between the business companies, and enhance internal and external communication.

• By making the common accounting system for the entire JFR Group fully operational, we aim to enhance management control and streamline operations. Additionally, we will promote IT governance, by strengthening our response to information security and business continuity, as well as by implementing system investments and advancing the level of sophistication for asset management.

(ⅳ) Corporate Governance

• Under the new management structure initiated from FY2024, we aim to make a number of governance improvements, such as speeding up the decision-making and execution of management and strengthening the supervisory function of the Board of Directors,

so as to realize growth over the medium to long term and continuously enhance corporate value.