- Home

- Sustainability

- Creating a society that co-exists with the environment

- Information Disclosure in Line with TCFD Recommendations

Information Disclosure in Line with TCFD Recommendations

In 2019, the Group expressed its support for the final report of the Climate-related Financial Disclosure Task Force (TCFD) (TCFD recommendations). The TCFD recommendations are a global common comparable framework for climate-related information disclosure and expect all companies to disclose information in accordance with the four recommended disclosure items including "governance," "risk management," "strategy," and "metrics and targets." While using the TCFD recommendations as guidelines for evaluating the adequacy of its climate actions, the Group will actively engage in dialogue with institutional investors to disclose information.

Four recommended disclosure items required of companies in the TCFD recommendations

|

Basic item |

Outline |

Specific disclosures |

|---|---|---|

|

Governance |

The organization’s governance around climate-related risks and opportunities |

● Process by which the Board of Directors receives reports on climate-related issues,

frequency with which these issues are placed on the

agenda, and monitoring |

|

Risk management |

How the organization identifies, assesses, and manages climate-related risks and opportunities |

● Details of the process for identifying and assessing climate-related risks and opportunities

|

|

Strategy |

The impacts of climate-related risks and opportunities on the organization’s businesses, strategy and finance |

● Details of short-, medium-, and long-term risks and opportunities |

|

Metrics and targets |

The metrics and targets used to assess and manage climate-related risks and opportunities |

● Metrics used to manage climate-related risks and opportunities |

Source: Recommendations of the Task Force on Climate-related Financial Disclosures (final report), 2017

Recommended Disclosure Item (1) Governance

(a) Process by which the Board of Directors receives reports on climate-related issues, frequency with which these issues are placed on the agenda, and monitoring of progress

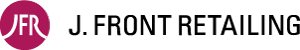

We promote sustainability management across the entire Group by reflecting in our business strategy our response to significant environment-related issues (including climate and nature-related risks and opportunities) that are highly relevant to our business, as well as initiatives that contribute to resolving these issues. These are deliberated and approved by the Group Management Meeting, the highest decision-making body for business execution. Furthermore, the Sustainability Committee, which meets at least twice a year, shares the policies on environmental issues deliberated and approved by the Group Management Meeting, formulates action plans to address issues within the Group, and monitors the progress.

The Board of Directors (meets monthly) receives reports on the activities of the Sustainability Committee and matters deliberated and approved by the Group Management Meeting, then supervises target setting, policies, and action plans.

Board of Directors skill matrix

In selecting candidates for the Board of Directors, we use a skill matrix to clarify the expertise and experience we expect from directors, and “environment” is one of the items. By appointing directors capable of providing appropriate supervision of specific action plans and regular reviews, and monitoring the status of initiatives for continual improvement of environmental plans, including the setting of medium- to long-term targets, we are enhancing the effectiveness of our efforts to address environmental issues.

(b) Management's responsibility for climate- related issues, process for receiving reports, and monitoring methods.

The President and Representative Executive Officer chairs the Group Management Meeting as well as the Risk Management Committee and the Sustainability Committee, which are both advisory panels under his direct control. The President thus bears final responsibility for management decisions related to environmental issues, including climate-related issues. Details of matters deliberated and approved by the Group Management Meeting and the Sustainability Committee are reported to the Board of Directors for final approval.

Executive remuneration system incorporating non-financial measures

Since FY2021, we have set reduction of Scope 1 and 2 emissions as one of the non-financial indicators for determining performance- linked compensation in officer remuneration. These are linked to the KPIs in the Medium-term Business Plan to clarify the responsibility of executive officers to achieve the targets for climate-related issues and to function as an incentive to realize and promote sustainability management.

Meeting bodies and their roles in the environmental management system

|

Meeting body and system |

Role |

|

|---|---|---|

|

Meeting body |

Board of Directors |

Supervises the progress of environment-related initiatives deliberated and approved by those who execute business. Meets monthly. |

|

Group Management Meeting |

Deliberates and approves policies and measures related to company-wide management as the highest decision-making body for business execution. Deliberates and approves company-wide management policies and other matters related to comprehensive risks and opportunities, including environment-related issues, as discussed by the Risk Management Committee and Sustainability Committee, and reports to the Board of Directors for approval. Meets weekly. |

|

|

Risk Management Committee |

Deliberates on the identification, evaluation, and response to comprehensive risks and opportunities, and monitors the risk responses of operating companies. Climate-related risks and opportunities are also integrated into the company-wide risk management framework and managed together with other risks. Deliberations by the Committee are reported to the Board of Directors. Held three times a year. |

|

|

Sustainability Committee |

Discusses specific measures to address more detailed issues related to sustainability, including environment-related issues deliberated and approved by the Group Management Meeting. Concerning climate-related issues, it monitors the progress of each operating company based on the Group's long-term plan and KGI/KPI, taking into account risks and opportunities. Dialogue also held with experts in climate- related issues. The contents of the discussions are reported to the Board of Directors. Held at least twice a year. |

|

|

Executing entity |

President and Representative Executive Officer |

Chairs the Group Management Meeting, and also the Risk Management Committee and the Sustainability Committee. Assumes the ultimate responsible for making management decisions on environment-related issues, including identifying, assessing, and responding to climate- related risks and opportunities, and promoting group-wide initiatives to resolve environment-related issues. |

|

Operating Companies |

Each operating company plans and implements specific measures to address environment-related issues based on the items approved by the Group Management Meeting and the deliberations of the Risk Management Committee and Sustainability Committee, and reports on the progress to the JFR Group's Risk Management Committee and Sustainability Committee. |

|

|

Sustainability Promotion Division |

Formulates and proposes Group policies and other measures to promote sustainability management. The division collects climate-related information on risks and opportunities, formulates the direction of medium- and long-term initiatives, and reports to the Group Management Meeting and the Sustainability Committee. |

|

Main environment-related agenda items of the Sustainability Committee

FY2023 |

April |

●FY2023 Sustainability Action Plan |

|---|---|---|

September |

●Lecture by an external instructor on "Overview and importance of biodiversity" |

|

FY2024 |

April |

●Lecture by an external instructor on "The Relationship Between Long-Term Corporate Value Enhancement and Non-Financial Activities" |

September |

●Employee engagement with materiality |

|

FY2025 |

April |

●Lecture by an external instructor on the "Introduction of Renewable Energy for the 2050 Net Zero Transition Plan" |

Recommended Disclosure Item (2) Risk Management

(a) Details of the process for identifying and assessing climate-related risks and opportunities

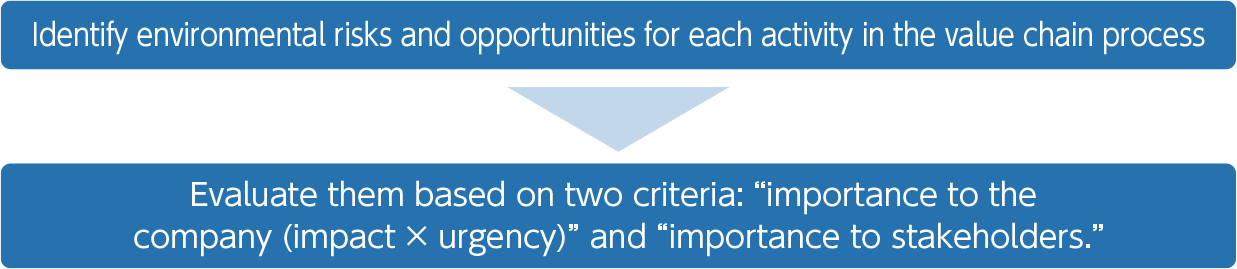

The Group positions risk to be the starting point of our strategy and defines it as "uncertainty that affects the achievement of corporate management goals and has both positive and negative aspects." We believe that when appropriately addressed, risk will lead to sustainable growth. This understanding also applies to environmental risks and opportunities, which we identify and evaluate from both the positive and negative perspectives.

(b) Details of the process for managing significant environmental risk and opportunities

The Company is working to share climate-related risks and opportunities with each operating company through a more detailed study of these risks within the Sustainability Committee. Each operating company incorporates climate change initiatives into their action plan and checks the progress of the action plan through discussions in meetings headed by the president of each operating company. Progress is monitored by the Group Management Meeting, the Risk Management Committee, and the Sustainability Committee, and is finally reported to the Board of Directors.

(c) Status of integration into the company-wide risk management framework

Recognizing that risk management is critically important to corporate management, we have established a Risk Management Committee (meets three times a year) to manage all risks, including environmental risks, in an integrated company-wide manner. The committee deliberates on important matters such as identification and evaluation of risks and the determination of which risks will be reflected in strategy. Because we position risk as the starting point of strategy, we strive to link risk management to the enhancement of corporate value by aligning our strategy with risk.

Risks that are extremely important to the Group's management over the medium term are positioned as "critical risks" and serve as the starting point for our Medium-term Business Plan. Significant risks are further broken down into "annual risks," allowing us to clarify the risks to be addressed each year and prioritize countermeasures. One of our key risks is the "growing importance of environmental issues," and we review environmental risks and opportunities on an annual basis.

The deliberations of the Risk Management Committee are reported to the Group Management Meeting and shared with the Sustainability Committee. Additionally, the contents of discussions in these bodies, as well as matters approved by the Group Management Meeting, are reported to the Board of Directors (meets monthly). Under this supervisory structure, we reflect risk-related matters in the Group's strategy and implement appropriate measures.

Recommended Disclosure Item (3) Strategy

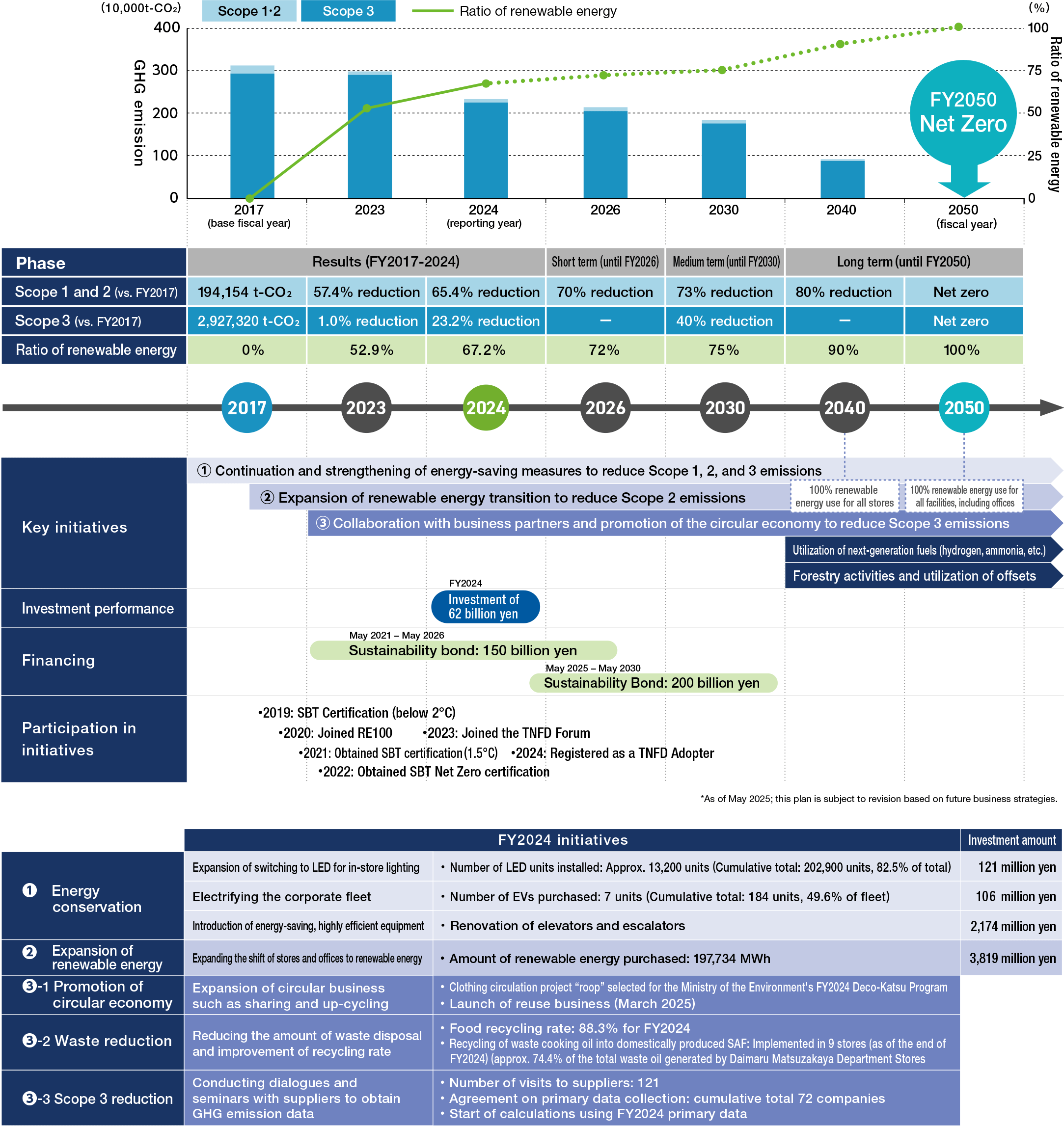

JFR Group's FY2050 Net Zero Transition Plan

Recognizing the need to take a medium- to long-term approach in order to achieve net zero by 2050, we have formulated a transition plan toward that goal. Based on the results of our analysis of climate-related risks and opportunities, as well as their financial impacts, we will implement appropriate countermeasures to address risks and actively respond to changing customer needs that represent new opportunities. In this way, we will promote specific initiatives from short-, medium-, and long-term perspectives, aiming to capture new growth opportunities. Furthermore, by integrating investment and funding plans with fiscal year initiatives in the transition plan, we will clarify the connections between these elements and enhance the plan's effectiveness.

(a) Details of short-, medium-, and long-term risks and opportunities

The Company considers it important to examine climate-related risks and opportunities at the appropriate milestone occasions because of the potential impact on its business activities over the long term. Accordingly, the Company has positioned the implementation period of the Medium-term Business Plan up to FY2026 as the short term; the period up to FY2030, which is the short-term target year set by SBTi, as the medium term; and the period to FY2050, which is the SBTi net zero target year, as the long term.

The Company has formulated the group strategy for climate-related risks and opportunities by backcasting from fiscal 2050, the target year for realizing net zero, and is working to implement the strategy.

Definition of the periods for considering climate-related risks and opportunities in the JFR Group

|

Periods for consideration of |

The Group’s definition |

|

|---|---|---|

|

Short term |

Until FY2026 |

Execution period of the Medium-term Business Plan |

|

Medium term |

Until FY2030 |

Period until the SBT target year for Scope 1, 2, and 3 emissions |

|

Long term |

Until FY2050 |

Period until the SBT net-zero target year for Scope 1, 2, and 3 emissions |

(b) Nature and extent of impact of risks/opportunities on business, strategy, and financial plans

The Company conducts scenario analysis on an annual basis to understand the risks and opportunities that climate change poses to our Group, assess their impact, and examine the resilience of our strategies under the assumed conditions of FY2030. This also enables us to consider whether additional measures are necessary to strengthen our response.

Implementation status of scenario analysis

Year of |

Summary |

Scenarios referenced |

Business |

|---|---|---|---|

2020 |

●Commencement of TCFD disclosure in annual securities report |

1.5℃ to under 2℃ scenario, 3℃ scenario |

Retail |

2021 |

●Review of scenarios |

Under 2℃ scenario, 4℃ scenario |

Retail |

2022 |

●Formulation of net zero transition plan |

1.5℃ to under 2℃ scenario, 4℃ scenario |

Retail |

2023 |

●Expansion of target businesses (addition of developer business) |

1.5℃ to under 2℃ scenario, 4℃ scenario |

Retail |

2024 |

●Revision of estimated financial impact in 2030 |

1.5℃ to under 2℃ scenario, 4℃ scenario |

Retail |

In the scenario analysis, we referenced multiple existing scenarios announced by the International Energy Agency (IEA) and the Intergovernmental Panel on Climate Change (IPCC), and then considered the two scenarios shown in the table below.

Explanation of the scenarios used in the analysis for FY2025

Estimated |

Existing scenarios referenced |

Assumed global scenario |

Target business |

|

|---|---|---|---|---|

Less than |

Transition |

"Net-Zero Emissions by 2050 Scenario (NZE)" |

Climate-related policies and regulations are being strengthened, with the world aiming to achieve the Paris Agreement's goal of "keeping the global average temperature rise well below 2℃ above pre-industrial levels and pursuing efforts to limit the temperature increase to 1.5℃." |

Retail business |

Physical |

"Representative Concentration Pathways (RCP2.6)" |

|||

4℃ |

Transition |

"Stated Policy Scenario (STEPS)" |

No new climate-related policies or regulations are introduced, and greenhouse gas emissions continue at the current pace, leading to climate change (average temperature rise of 2.6℃ to 4.8℃). |

|

Physical |

"Representative Concentration Pathways (RCP8.5)" |

|||

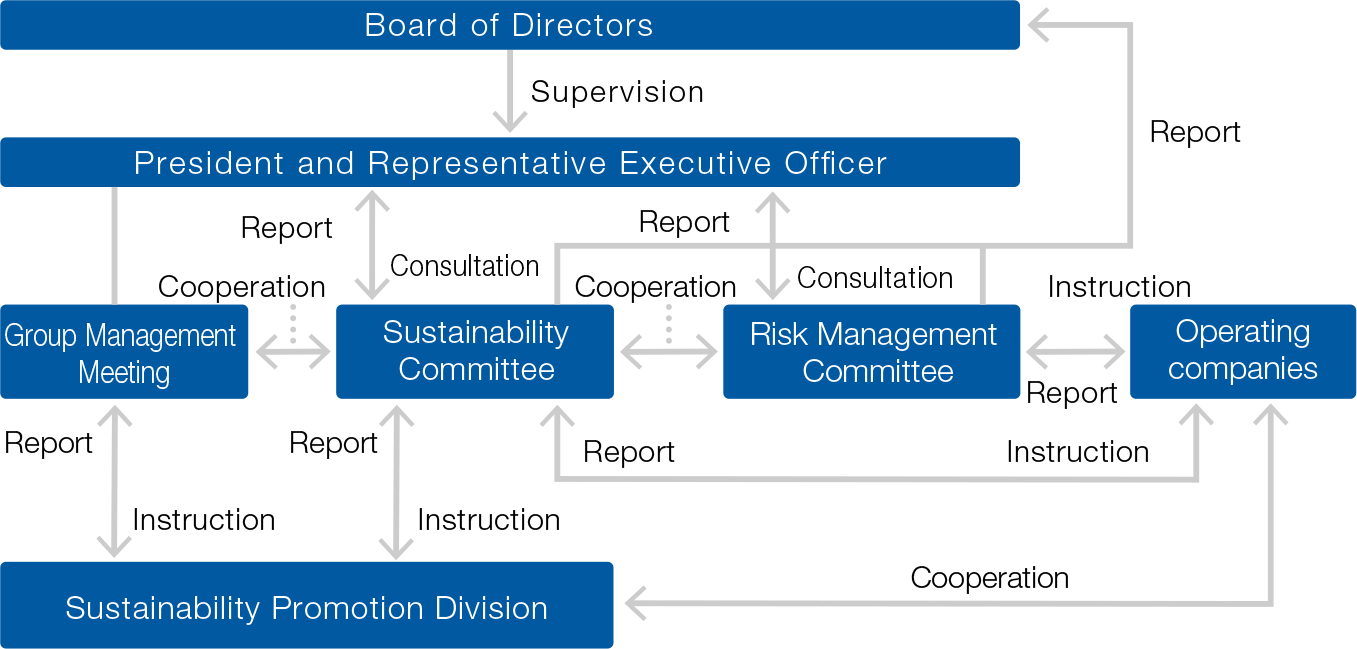

Based on these scenarios, we identified climate-related risks and opportunities in accordance with the TCFD recommendations, targeting our core businesses, retail and developer operations, and examining each activity within their value chain processes. Building on this, we identified transition risks (such as policy and regulatory changes, technological shifts, market trends, and reputational impacts), physical risks (both acute and chronic), and opportunities arising fro appropriate responses to climate change (including resource efficiency, energy sources, products and services, market shifts, and resilience).

(c) Risks/opportunities and financial impacts based on relevant scenarios and strategies/resilience against them

The Company assessed the importance of the identified climate-related risks and opportunities based on two criteria: the “importance to the Group (degree of impact × urgency)” and “importance to stakeholders.” For items that were evaluated to be of particular importance, we assessed the financial impact of two scenarios, a 1.5℃/less than 2℃ scenario and a 4℃ scenario, from both quantitative and qualitative perspectives for FY2030, and developed countermeasures for each scenario. Risks and opportunities for which it is difficult to obtain information to quantitatively assess the financial impact have been evaluated qualitatively, and the results are indicated in three levels according to the slope of the arrow.

Climate change risks and opportunities of particular importance to the JFR Group and their financial impacts in FY2030

Impact on JFR Group’s business and finances expected to be very large

Impact on JFR Group’s business and finances expected to be somewhat large

Impact on JFR Group’s business and finances expected to be negligible

|

Type of climate- |

Timing of emergence |

Climate-related risks and opportunities of |

Financial impact |

Measures |

||||

|---|---|---|---|---|---|---|---|---|

|

Short- |

Medium- |

Long- |

Below 1.5℃/2℃ |

4℃ |

||||

|

Risks |

Transition |

● |

● |

・ Increase in costs associated with intro-duction of carbon tax, etc. |

Approx. |

Approx. |

●Reduction of GHG emissions through aggressive energy conservation measures in stores and expansion of renewable energy switching to achieve the 2050 net zero target |

|

|

● |

● |

● |

・ Increase in costs associated with the development of properties with high environmental performance and the installation of equipment |

|

|

●Financing through Green Bonds, etc. ●Introduction of cost-effective equipment |

||

|

● |

● |

● |

・ Increase in investment for introduction of high-efficiency, energy-saving equip-ment |

|

|

●Use of internal carbon pricing ●Review of cost-effective facilities and planned investment |

||

|

● |

● |

・ Increase in renewable energy pro-curement costs due to increased demand for electricity derived from renewable energy |

Approx. |

Approx. |

●Use of internal carbon pricing ●Reduction of procurement risks and mid- to long-term costs through diversification of renewable energy procurement methods ●Improvement of energy self-sufficiency through installation of renewable energy equipment in the company's facilities, etc. |

|||

|

Physical |

● |

● |

・ Decrease in revenue due to store closures caused by natural disasters |

Approx. |

Approx. |

●Increased resilience of stores and business sites through BCP preparation ●Improvement of disaster prevention performance of stores |

||

|

Opportunities |

Energy sources |

● |

● |

● |

・ Decrease in energy procurement costs due to introduction of high-effi-ciency, energy-saving equipment |

Approx. |

●Timely upgrades to high-efficiency, energy-saving equipment |

|

|

Products |

● |

● |

・ Expansion of revenue through decar-bonization of the entire value chain and acquisition of business opportunities by providing environmentally friendly products and services in collaboration with business partners, including new value co-creation partners |

|

|

●Expansion of environmentally friendly products and services handled ●Recycling of waste cooking oil as domestically produced SAF ●Hold supplier briefings ●Calculating GHG emissions, setting reduction targets, requesting primary data on emissions, and other collaborative efforts with suppliers toward decarbonization |

||

|

Markets |

● |

● |

● |

・ Expansion of new growth opportuni-ties through new entry into the circular business |

|

|

●Expansion of circular businesses such as sharing, upcycling, and reuse, including the fashion subscription service "AnotherADdress" ●Launch of "MEGRÜS" reuse business |

|

|

● |

● |

● |

・ Expansion of profits due to increased opportunities to acquire new tenants through conversion to stores with high environmental value |

Approx. |

– |

●Acquisition of environmental certification for newly developed properties (ZEB, CASBEE, etc.) ●Promotion of energy conservation in stores toward realization of RE100 |

||

<Basis for calculation of quantitative financial impacts in FY2030>

*1. Calculated by multiplying JFR Group's projected Scope 1 and 2 GHG emissions in FY2030 by the carbon price per t-CO2.

*2. Calculated by multiplying the JFR Group's electricity consumption in FY2030 by the price per kWh of electricity derived from renewable energy compared to the regular electricity rate.

*3. Calculated by multiplying the amount of lost sales due to store closures caused by past natural disasters by the projected frequency of future flooding.

*4. Calculated by multiplying energy procurement costs by the projected amount of energy savings by the JFR Group in FY2030.

*5. Calculated by multiplying the JFR Group's projected real estate revenues in FY2030 by the projected rate of change in new contract conclusion fees for buildings with environmental certification.

Major parameters

Parameters |

Source |

|---|---|

Carbon tax price |

"Net-Zero Emissions by 2050 Scenario (NZE)" (IEA, 2024) |

"Stated Policy Scenario (STEPS)" (IEA, 2024) |

|

High electricity prices from renewable energy |

"Japan's Energy 2023" (Ministry of Economy, Trade and Industry / Agency for Natural Resources and Energy, 2024) |

Frequency of future flood occurrence |

"Representative Concentration Pathways (RCP8.5)" (IPCC, 2014) |

Impact Assessment of Carbon Pricing

By working to reduce GHG emissions in line with the SBT "1.5℃ target" and "net zero target," we will minimize the medium- to long-term risk of increased costs associated with the anticipated introduction of carbon pricing measures such as a carbon tax.

|

FY |

1.5℃ scenario |

4℃ scenario |

|---|---|---|---|

If GHG emissions are |

2030 |

1,100 million yen |

1,000 million yen |

2050 |

0 yen |

0 yen |

|

If GHG emissions are |

2030 |

1,700 million yen |

1,700 million yen |

2050 |

3,100 million yen |

1,800 million yen |

Summary of Resilience

Based on the assumed scenarios, we have analyzed the impact of climate change and examined our countermeasures, confirming that the measures the Group has already implemented and planned are effective and flexible enough to reduce risks and contribute to the realization of opportunities under any of the scenarios. We will continue to work to enhance the resilience of our management.

We will systematically and steadily implement measures to mitigate financial risks associated with increased costs due to the introduction of carbon taxes and other policies, as well as the impact of natural disasters on revenues. Additionally, we will leverage our Group's unique strengths in sharing, upcycling, and reuse businesses to promote circular economy initiatives that contribute to the growth of our group and the realization of a decarbonized society.

By promoting initiatives that address both the risks and opportunities of climate-related issues, we will enhance the resilience of our management.

Recommended Disclosure Item (4) Metrics and Targets

(a) Metrics used to manage climate-related risks and opportunities

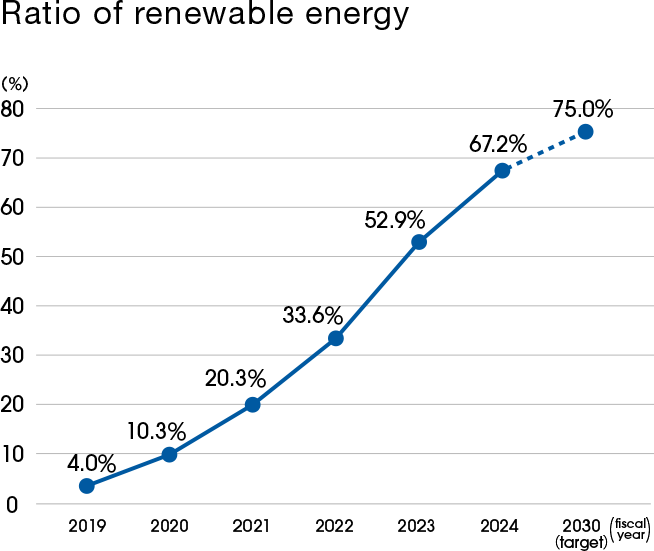

The Company has established two metrics for managing climate-related risks and opportunities: Scope 1, 2 and 3 GHG emissions, and the ratio of renewable energy to total electricity used in business activities.

Also, to clarify the responsibility of executive officers regarding the issue of climate change, Scope 1 and 2 GHG emission reduction targets were set as one of the non-financial indicators for determining performance- linked compensation in officer remuneration.

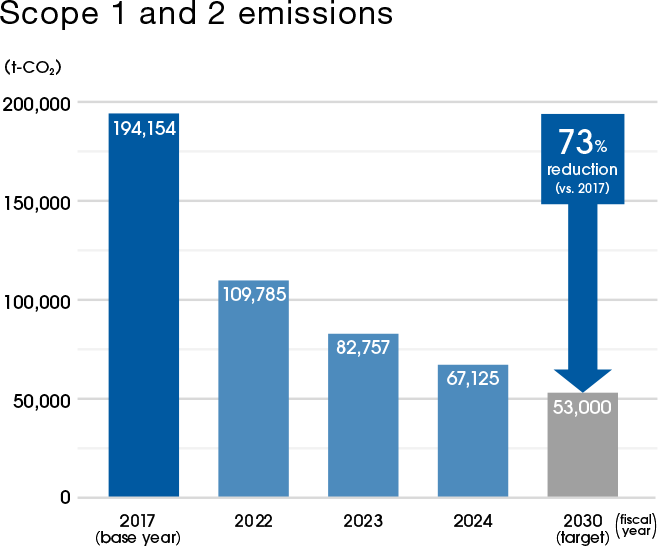

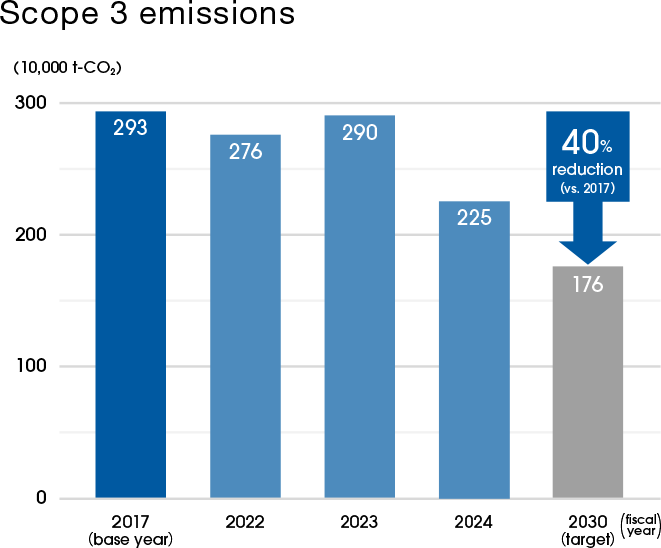

(b) GHG emissions (Scope 1, 2, and 3)

The Company has been calculating its total emissions since fiscal 2017. Our Scope 1 and 2 emissions in FY2024 were 67,125 t-CO2 (65.4% reduction vs. FY2017) and Scope 3 emissions were 2,247,051 t-CO2 (23.2% reduction vs. FY2017). In addition, the ratio of renewable energy was 67.2%.

Third-party assurance has been obtained for Scope 1, 2, and 3 emissions and renewable electricity consumption.

JFR Group's Scope 1, 2, and 3 GHG emission results and outlook*1 (Unit: t-CO2)

FY2017 |

FY2023 |

FY2024 |

|||

|---|---|---|---|---|---|

Actual*1 |

Actual*1 |

Actual |

Compared with FY2017 |

||

Scope 1 emissions |

16,052 |

14,021 |

14,430 |

-10.1% |

|

Scope 2 emissions |

(market-based) |

178,102 |

68,736 |

52,695 |

-70.4% |

(location-based) |

184,047 |

142,935 |

136,692 |

-25.7% |

|

Scope 1 and 2 emissions total*2 |

194,154 |

82,757 |

67,125 |

-65.4% |

|

Scope 3 emissions*3 |

2,927,320 |

2,898,436 |

2,247,051 |

-23.2% |

|

Scope 1, 2 & 3 emissions total*2 |

3,121,474 |

2,981,193 |

2,314,176 |

-25.9% |

|

Renewable energy ratio (%) |

– |

52.9 |

67.2 |

– |

|

*1. Obtained third-party assurance from LRQA Limited.

*2. Scope 2 emissions used in the total are calculated with market-based data.

*3. Basic Guidelines on Calculating for Greenhouse Gas Emissions Throughout the Supply Chain, Version 2.7 (March 2025, Ministry of the Environment, Ministry of Economy, Trade and Industry)," and "Emissions Unit Database for Calculating Greenhouse Gas Emissions of Organizations Throughout the Supply Chain, Version 3.5 (March 2025)," and IDEAv3.3 (for calculating greenhouse gas emissions in the supply chain)

(c) Targets and results used to manage climate-related risks and opportunities

Since fiscal 2018 the Company has set long-term GHG emission reduction targets to achieve the global below 1.5℃ /2℃ target, and our reduction targets for Scope 1, 2, and 3 emissions were certified by the SBTi in fiscal 2019. In fiscal 2021, in line with the advancement of our materialities, we raised our target for reducing 2030 Scope 1 and 2 emissions from the previous 40% to 60% compared with FY2017(base year), and it was approved as the 1.5℃ target that is the new standard set by the SBTi. Moreover, in February 2023, we also obtained certification for the 2050 Net Zero Target for Scope 1, 2, and 3 GHG emissions.

To achieve these long-term targets, the Company started procuring renewable energy-sourced electricity for its own facilities in fiscal 2019, and in October 2020 we joined RE100*, which aims to achieve a 100% renewable energy share for electricity used in business activities by fiscal 2050. Moreover, as an interim target, we aim to achieve a 60% renewable energy share for electricity used in business activities by fiscal 2030.

Looking ahead, we will work to expand procurement of renewable energy-sourced electricity towards achieving net zero by fiscal 2050.

* A global initiative with the goal of 100% renewable energy for electricity used in business activities by 2050.

Early achievement of 2030 targets and establishment of new goals

As of the end of February 2025, we had already achieved our 2026 and 2030 targets (60% reduction in Scope 1 and 2 emissions, a 60% renewable energy ratio). Accordingly, we have set more ambitious targets for 2030. Additionally, to ensure steady progress toward net zero emissions by 2050, we have established a new medium-term target for 2040.

Targets used by the JFR Group to manage climate-related risks and opportunities

Metrics |

Target year |

Details of targets |

|---|---|---|

GHG emissions |

2050 |

Net zero emissions of Scope 1, 2, and 3 GHG emissions*1 |

2030 |

73% reduction of Scope 1 and 2 GHG emissions (vs. FY2017)*2 |

|

Ratio of renewable energy in electric power used in business activities |

2050 |

100%*4 |

2040 |

90% |

|

2030 |

75% |

*1. Obtained SBT certification in FY2022 for Net Zero targets

*2. Obtained SBT certification in FY2021 for the "1.5℃ target" (60% reduction vs. FY2017 before the target was revised)

*3. Obtained SBT certification in FY2021 for "1.5℃ target"

*4. Joined RE100 in 2020

Use of internal carbon pricing (ICP)

In February 2024, we established Internal Carbon Pricing (ICP) for visualizing CO2 emissions as a cost by converting them into monetary values. The goal is to foster awareness inside the Company of the need for decarbonization and promote decision-making aligned with decarbonization investments. (Internal carbon price: 10,000 yen/t-CO2).

In FY2024, we utilized ICP to compare and evaluate renewable energy procurement costs when reviewing the 2026 and 2030 renewable energy targets. Looking ahead, we will also consider incorporating ICP into real estate investment criteria, with the aim of creating business opportunities and promoting decarbonization management across the entire Group.

Creating a society that co-exists with the environment

-

Aiming to Achieve Net Zero by 2050

-

Environment Management System

-

Information Disclosure in Line with TCFD Recommendations

-

The Circular Economy the Group aims to create

-

Proposal for Environment-Friendly Lifestyles

-

Reduction of Wastes and Water Usage

-

Information Disclosure in line with TNFD Recommendations (Biodiversity Conservation)

-

Environmental Data

-

Acquisition of Third-Party Assurance